Software Defined Vehicles

Automotive Edge

From Supplier to Software Company

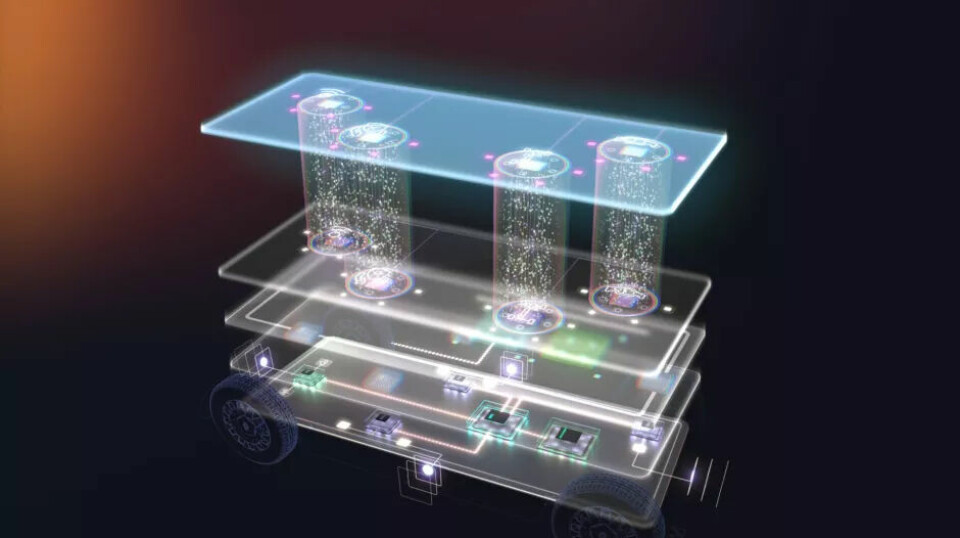

The future of software-defined suppliers has begun. For example, Continental has developed its own platform for software-defined vehicles with its Automotive Edge Platform. Just one example among many.

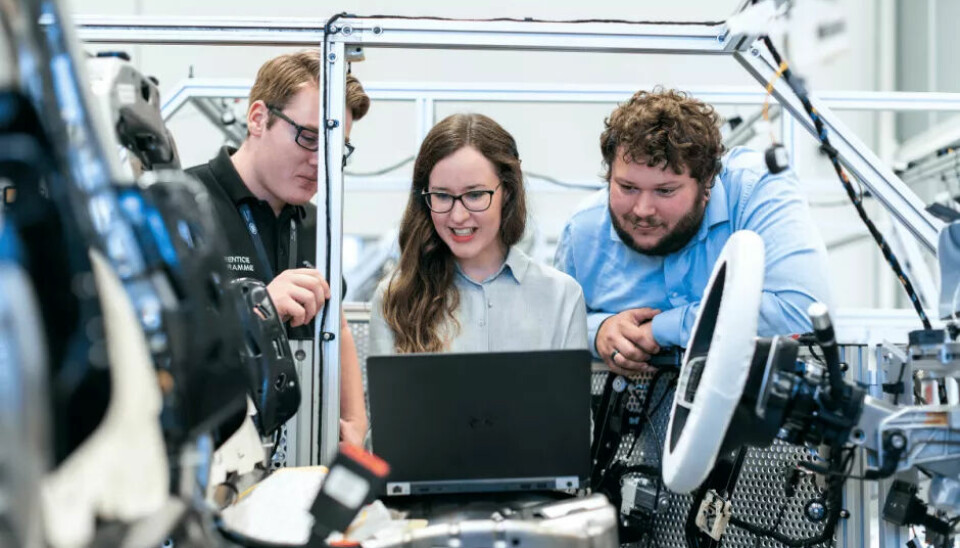

"Almost all companies in the automotive industry are increasingly transforming into software companies," says Michael Tenschert, an expert in software solutions in the automotive sector at Capgemini in Germany. "As a result, the business models of most suppliers are under pressure and they must reinvent themselves if they want to remain relevant in the market." A crucial role is played by the separation of hardware and software - as this allows one to adapt their offering to the development that is happening, especially among manufacturers.

Christof Horn, an automotive expert at Accenture, sees it the same way: "The cards in the automotive value chain are being reshuffled. The previous complete packages of hardware and software, which were delivered by the 1st Tier as a black box, are being unbundled: OEMs are breaking up the traditional vertical value chains and buying horizontally," he observes.

"Delivering a black box of hardware and software is no longer sufficient," explains Tenschert. "The software from different suppliers must be flexibly and independently integrable into the manufacturers' hardware - and this integration must be able to occur earlier in the development process and independently of hardware." Only in this way can the time-to-market be significantly reduced. Last but not least, software must be continuously updated and rolled out. Tenschert: "Therefore, suppliers who have fundamental software expertise are at an advantage."

Development cycles are massively shortened

Continental has long since developed this with CAEdge, among other things. It is a cloud-based development environment for SDVs. It was set up in 2020 together with AWS to reduce the dependency on physical hardware in the development and testing of vehicle software. "This shortens development cycles, which used to take weeks, to just a few minutes through virtual ECUs and automated cloud processes," reports Thomas Kiendl, Cloud Solution Architect at Continental. "CAEdge also offers a collaborative environment for distributed teams and projects. The platform enables test environments to be provided flexibly and automatically - independent of physical hardware and on a large scale."

Virtual control units (vECU Creator) in CAEdge, which enable digital twins of physical control units, primarily ensure more speed in development. These vECUs run on custom Amazon EC2 instances and support various operating systems (such as Android, Linux, QNX, Classic AUTOSAR). Developers can create and test vECUs via a user interface - including audio/video streaming and CAN simulation. The vECU Creator and CAEdge expand the classic supplier model, explains Kiendl: "In addition to hardware and software, Continental provides a platform for virtual tests as well as reference ECUs." Thus, the supplier becomes a platform provider to some extent. "Although we do not become an infrastructure provider, we use existing hyperscalers with AWS to massively accelerate the development process," emphasizes Kiendl.

While suppliers will of course never be able to compete with hyperscalers, they will increasingly come up with specialised solutions and offer them to third parties: "We are seeing more and more attempts to make the tools already used for their own development available to others and thus monetise them," says Tenschert.

More value creation share for suppliers?

Feature on Demand services and increasingly AI-based functions also play a major role. An example of this is the "Travel Companion Cloud Platform", which Continental offers as a white-label solution for OEMs. "This platform is based on machine learning and recommends services to the user based on their personal profile and current context," explains Kenneth Malmberg, Head of Business and Portfolio Management at Continental. Drivers can subscribe to services that match their interests and needs. "The Travel Companion is just one example of how Continental enables personalisation in the SDV," says Malmberg, "and makes every vehicle an 'Experience Defined Vehicle', where the user can choose functional upgrades throughout the vehicle's lifecycle."

This allows suppliers to grow into a new (lucrative) role. "With the transformation to SDV, suppliers like Continental are focusing more on flexible software solutions and services and will be involved in a larger part of the value chain," says Malmberg. "While collaboration was previously more component-oriented, the SDV model requires an additionally closer, software-centric partnership between suppliers and OEMs." This leads to new forms of collaboration and business models. "In doing so, suppliers take on a central role in the development and integration of software solutions," Malmberg emphasizes. "This offers new opportunities for the 1st Tier, but also requires a restructuring of their organizations and capabilities," says Horn.

There will no longer be one-size-fits-all solutions

"Fundamentally, holistic toolchains offer numerous advantages, but they also cause a high effort," Tenschert interjects at this point. "It must be clearly defined what responsibility OEMs, partners, and suppliers have in software development." Suppliers could, for example, focus on fast releases, quick feedback, and virtualization to accelerate the entire development process. "The OEMs then take over the final integration, meaning they are responsible for the integration toolchain," says Tenschert. "Traditional car manufacturers will rather invest in optimizing their own solution components."

It may also be sensible to jointly develop non-differentiating components within the framework of collaborations - for example, based on open source software - thereby reducing diversity in integration. "For efficient collaboration on a software basis, a modular and scalable SDV platform is crucial," says Tenschert. Highly specialised solutions for dedicated domains or industry sectors have great potential, provided they can be easily integrated into existing IT landscapes and platforms.

Industry experts expect that the supplier market will change. "It will increasingly split into hardware and software suppliers," says Tenschert. "This also means: A new market for system integrators and middleware providers is emerging." In some cases, a company will offer all three components. "The traditional business model of Tier-1 suppliers is thus changing drastically," emphasises Tenschert. "Suppliers will increasingly focus their expertise, so core functions in the ADAS area, such as autonomous parking, are clearly placed with the supplier." The art lies in finding the right combination for the individual path of each OEM and for specific projects. Tenschert: "One size fits all solutions will tend to disappear in the future."

This article was first published at automotiveit.eu