Software Defined Vehicles

The Automotive Industry on the Brink of Change

These are the Strategies for the Software-Defined Vehicle (SDV)

It is now important to consider Software-Defined Vehicles (SDV) more holistically. After all, completely new business models are associated with them. Who is adopting which strategy?

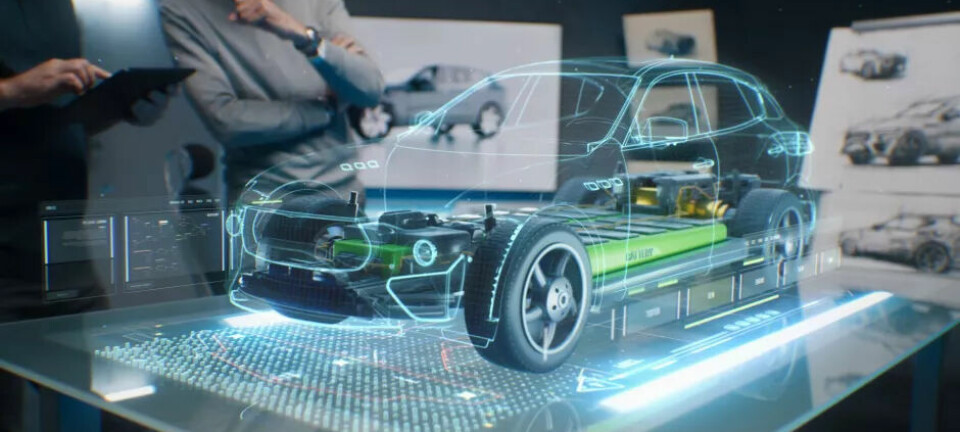

Driven by digitalisation, ESG requirements, and geopolitical uncertainties, the industry is undergoing a profound structural change. The software-defined vehicle becomes the symbol of this change: AI-supported assistance systems, personal services, and regular over-the-air updates push hardware into the background and bring software and data into the spotlight. Those who do not quickly align their business model with this new reality risk missing the crucial development leap - and thus more than just a few market shares.

What dominant SDV strategies can be identified?

The importance of software-defined vehicles (SDV) leads to a strategic rethinking across the entire industry. A central goal is to build in-house software expertise. The paths to this differ from manufacturer to manufacturer.

Three dominant strategies can be identified:

- In-house development with a central software platform: More and more large OEMs with corresponding resources and capital reserves rely on in-house software development and create internal competence centres. They invest in in-house development teams and their own platforms to control innovation speed and quality more independently. Internal software departments and specialised subsidiaries develop complete operating systems and software stacks, so that hardware and software merge into an integrated value creation unit. The goal is a consistent software platform that is used in various vehicle segments. This creates a certain independence from suppliers on the one hand, but the development effort is immense.

- Cooperations and alliances with technology partners: In parallel, many companies rely on partnerships with tech firms to master the complexity and high resource requirements in software development. Joint ecosystems and open platforms shorten development cycles and pool know-how - from cloud solutions to AI-based services. Open standards and open-source initiatives also create flexibility in integrating different software components. This strategy can increase development speed and quality, but it carries the risk that important competencies are built outside the OEM.

- Hybrid approach with acquisitions and targeted cooperations: Companies specifically bring in specialist knowledge and technologies, for example by acquiring software start-ups, while continuing to work closely with traditional suppliers. This combines internal know-how with external impulses and maintains a certain flexibility.

The choice of strategy strongly depends on how much capital, software competence, and market power a manufacturer already possesses. A newcomer with a digital focus will rather prioritise the direct build-up of software teams, while established OEMs restructure existing resources or bring partners on board.

SDVs: Redefining value creation in the automotive sector

The latest study by the Center of Automotive Management (CAM) highlights that software-defined vehicles are not just a technological leap, but a redefinition of value creation in the automotive sector - and this in a market environment characterised by declining margins and intense competitive pressure, according to the CAM study.

In addition to internal skills development and the establishment of technical platforms, the SDV transformation also requires new cooperation and alliance models. According to the CAM study, this is the only way to "mitigate risks and unlock long-term growth opportunities." And this will be necessary: In a time when margins are shrinking and competition from different regions is increasing, success in the software-defined vehicle sector will become a crucial factor for the future viability of the entire industry.

User-centric services and subscription models

Particularly through user-centric services and subscription models, attractive revenue potentials arise: Over-the-air updates, unlockable additional functions, and personalised offers accompany the entire vehicle lifecycle and bind customers to the brand in the long term. Infotainment, comfort, and safety features thus become digital touchpoints, enabling ever closer interaction between manufacturer and end customer.

To manage this dynamic development, companies rely on agile organisational structures. Methods such as Continuous Integration/Continuous Deployment and DevOps enable the introduction of new features within a few weeks instead of multi-year development cycles. This shifts the competition to the speed and quality of software innovations.

Interviews with CEOs and executives reveal the following strategic directions:

BMW: Digital First

BMW is increasingly focusing on Digital First and targeted software services to strengthen the connection with customers. In addition to the in-house BMW Operating System platform (currently version 8, soon version 9), the focus is particularly on user experience. The guiding principle includes:

- Premium digital experience: An intuitively operable user interface and comprehensive connected services are to be the core of the driving experience. Subscription models for additional functions, such as seat heating or temporary driver assistance functions, create new revenue streams.

- Partnerships: In the software-defined vehicle sector, BMW works closely with technology companies and semiconductor manufacturers to make the E/E architecture powerful and secure.

- Smart data analysis: Using vehicle and user data, BMW identifies utilisation, maintenance needs, and customer preferences in real-time. The continuous data feedback enables targeted further developments and product improvements.

Volkswagen: One operating system for all brands

Volkswagen is pursuing an ambitious software offensive with its subsidiary Cariad. The core is a unified platform that is to be gradually used at Audi, Porsche, VW, and other group brands. The core aspects at a glance:

- Central architecture: Instead of numerous separate control units, there will be a scalable, group-wide software and hardware structure.

- Challenges: The complexity due to different brand philosophies and model series is enormous. This has already caused delays in important vehicle projects.

- Outlook: With CARIAD, VW wants to determine in the long term how data is collected, evaluated, and monetised. OTA updates, personalisation, and AI-based assistance functions are just the beginning.

Mercedes-Benz: MB.OS as the key to the luxury strategy

Mercedes-Benz has also recognised that future market success will lie in the digital customer experience. With "MB.OS", the Stuttgart OEM is creating a central software platform for all new model series.

The in-house operating system is used as a basis to create a luxury experience on all levels - from the high-resolution cockpit display to highly automated driving (Level 3) to personalised entertainment features.

In-house expertise and proprietary development environments are intended to ensure that value creation and control over data and software cycles are maintained. With a well-thought-out user interface and advanced AI functions, Mercedes aims to underline its premium claim and increase customer satisfaction in the long term.

Stellantis: Software offensive with global partners

The Stellantis group - with brands such as Peugeot, Citroën, Opel, Fiat, or Jeep - has presented a comprehensive software roadmap aimed at consolidating model diversity and leveraging synergies. The core here:

- Multiple platforms: With 'STLA Brain', a central computing architecture is being created, which will be used in different vehicle classes (STLA Small, Medium, Large, Frame).

- Collaborations: The group is working closely with tech partners like Foxconn and Waymo to quickly catch up in highly automated functions, AI, or infotainment.

- Monetisation model: Similar to other OEMs, the software strategy is closely linked to new business models. Stellantis plans to offer additional digital services and OTA updates in a modular form.

Renault: Software République as an innovation network

The Renault group relies on alliances to quickly advance in areas such as artificial intelligence, cybersecurity, and software development. As part of the Software République ecosystem, Renault is working with partners from various industries to optimise the E/E architecture and data-based services.

Open innovation culture: As part of a larger network, all participants should benefit from mutual know-how - for example, in edge computing, cloud technologies, or big data analysis.

Customer benefit in focus: Renault wants to offer a dynamic portfolio of services in future vehicles: from route planning with real-time traffic data to remote diagnostics and OTA function updates.

NXP: Market players without legacy issues are the pace setters

Sebastién Clamagirand, Senior Vice President, Automotive System and Marketing at NXP, assesses the profound shift towards a higher development pace and shorter time-to-market as follows: “This development is mainly shaped by new market players without legacy issues, particularly Chinese car manufacturers. With their strategy of bringing new models to market every two years, they are increasingly putting established Western manufacturers under pressure to fundamentally rethink and adapt their processes and approaches.

Despite different technical approaches in the industry, Clamagirand keeps an eye on the commonalities, including the centralisation of vehicle architecture, a bottom-up integration, the separation of hardware and software, and the continuous upgradeability of the vehicle.

NXP recognised the trend towards SDV early on and subsequently developed the NXP CoreRide solution: "The aim is to shorten the time to market for our customers and reduce their total cost of ownership when they choose NXP solutions. NXP CoreRide offers a reference design at the level of electronic control units (ECUs) that takes into account the various E/E architectures available on the market and provides high-quality software and optimised performance for the key use cases in the vehicle," describes Sébastien Clamagirand the NXP solution.

One of the biggest challenges for the automotive industry in transitioning to SDV is the availability of the right software and the ability to manage it effectively. For this reason, NXP recently announced the acquisition of TTTech Auto, a leading provider of safety-critical system and middleware solutions for the software-defined vehicle.

Vector Informatik: Complete solutions

Due to its many years of experience in automotive software, Vector Informatik is a sought-after cooperation partner for car manufacturers and suppliers in the development of SDVs. Managing Director Dr. Matthias Traub says: "We are proud to be one step ahead of the trend and to have extensive expertise in the field of SDV. We have already successfully used our solutions in large projects, such as the development of MB.OS for Mercedes Benz, STLABrain for Stellantis, and in cooperation with Mahindra in the Born Electric project. Our many years of experience in automotive software development give us a significant advantage as a total solution provider."

The SDV portfolio of Vector Informatik focuses on a complete solution for SDV, which is built on three essential areas: Software Platform, Software Factory, and SDV Services.

The holistic software platform for in-vehicle and cloud is an end-to-end solution. This software architecture enables OEMs to focus on creating customer-differentiating applications that can be used across various vehicle platforms, independent of the underlying hardware architecture. Vector's software platform is modular and provided as source code, allowing Tier1s and OEMs to integrate and expand it flexibly.

The Software Factory offers a seamless solution for a development environment from app development through integration, SIL & HIL testing to deployment in the vehicle fleet. Through highly automated processes, developers can focus on their respective roles, and customers achieve significantly shorter release and development cycles.

In addition to implementing the software platform and setting up the Software Factory, Vector Informatik supports customers throughout the entire SDV development process with its SDV Services and offers a comprehensive service portfolio. Specifically tailored to projects in the SDV environment, Vector Informatik advises on architectural requirements and design, efficient integration, test strategies, and workflow automation.

KPIT: Harmonisation and partnerships

KPIT pursues a holistic approach to accelerating the SDV transformation, focusing on architecture harmonisation, early validation, and strategic alliances. To make the implementation of centralised architectures more efficient, the company recommends unified software and system architectures as well as early hardware/software validation on virtual platforms.

Through investments in companies like Technica Engineering, NDream, and Qorix, KPIT has strategically built competencies across the entire technology stack over the past five years. The ecosystem is complemented by partnerships with chip-to-cloud companies to offer OEMs comprehensive solutions.

In the European market, KPIT calls for closer, strategic collaboration with OEMs to accelerate innovation and proactively address quality issues. Particularly in the area of cybersecurity, the company sees significant challenges: growing attack surfaces, incomplete risk analyses, and vulnerabilities in complex supply chains. With a comprehensive security approach - including TARA, penetration testing, and compliance with R155/R156 - KPIT positions itself as a solution provider for secure and future-proof SDV architectures.

Who will discover the holy grail of the automotive industry?

The software-defined vehicle marks nothing less than a paradigm shift in the automotive industry. Instead of a static product that only receives a facelift or a new model every few years, a highly connected "update-capable" vehicle takes centre stage. Companies can develop new business models based on continuous improvements and personalised driving experiences. Customers benefit from increased safety, individual settings, and constant updates that enhance the vehicle's value in the long term. Those who bravely shape this change will become key drivers of tomorrow's mobility - and may indeed discover the proverbial "holy grail" in the industry.

This article was first published at all-electronics.de